Today, Etsy CEO Josh Silverman sent out an email to all shop owners that listings with “Free Shipping” will be given priority in searches. The justification? “Online shoppers expect free shipping everywhere they go. Etsy is no exception.” Sadly, this is becoming truer every day. What shoppers don’t realize is that they are actually paying MORE when purchasing listings that offer Free Shipping. There are winners with the free shipping scenario, but it’s not the shopper and usually not the seller. Here is why….

First, let’s separate the perception of value with free shipping and the actual math. Everyone loves a deal. This is why concepts like “Sale”, “We Pay the Sales Tax”, “Discount” and now “Free Shipping” give the buyer the perception of scoring some kind of shopping win. It’s that feel good moment in the transaction that gives the shopper comfort that they received a better value for their money. However, the reality, and math, does not support this perceived value.

To get real, no seller absorbs the cost of shipping and takes that hit to their profitability. It’s not a sustainable business model to eat, what is often one of the largest, expenses of operating an online store. The cost of getting that purchase to the customer is either charged separately or factored into the price of the product. However, how shipping costs are passed along to the shopper effects the final price paid by the consumer. Here is the math behind why.

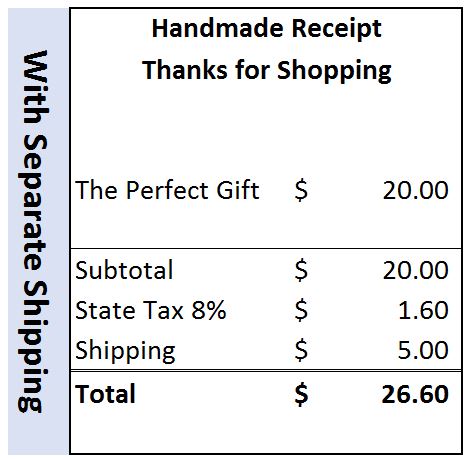

Here is the scenario for a simple online purchase. Let’s start with and use round numbers for simplicity.

Susie finds a cute gift idea for a friend’s birthday online. It’s perfect! Item X is available for $20. Shipping is a flat $5. Sales tax is 8%. Not too shabby, but she is hesitant because she has to pay for shipping and feels that shipping should be free because that’s what Amazon offers. Here are the costs for the transaction if she decided to proceed.

Now, here is the same purchase with shipping rolled into the price of the product so that “Free Shipping” can be offered. Notice that the taxable subtotal is higher, meaning that the entire purchase is now subject to sales tax. This results in a final cost to the shopper being $.40, or 1.5% higher compared to the transaction with shipping separated. All because of what total sales tax is calculated while projecting the illusion of “Free Shipping”.

Here is the side by side comparison.

Don’t worry, it does get worse. With a purchase that includes multiple items, that 1.5% increase can easily become 5%, 10% or more!! The why is a two-part explanation. First, the taxable portion of the purchase is larger as explained above. However, the biggest hit comes from the absence of discounted, or combined, shipping for additional items. Typically, a seller charges a flat shipping fee for the first item, then for each additional item a small increase in shipping. So, it if costs $5 to ship one item but you want to purchase two, the seller will give you a discount on shipping that second item in the box. For example: $5 for the first item and $2.50 for each additional item on the same transaction. Shipping cost for two items is $7.50, not double. However, with shipping rolled into the purchase price, the shopper can’t realize that multiple item shipping discount. Here is the comparison for a three-item purchase.

So, free shipping is not free and, in most cases, costs the shopper more. Yes, there are a million variables that can affect the calculation. Sales tax state, no sales tax state, is sales tax applied to shipping costs or not, will a seller eat all or part of the shipping costs, sales, discounts and whatnot. Regardless, in the end, someone is paying for shipping. It all comes down to who and how much. Chances are it’s the shopper whether they know it or not.

Who is the real winner with Free Shipping? It’s not hard to deduce that the shopper is not the true winner here. So, who is and why have large online retailers really been pushing this concept for “Free Shipping”? That’s easy, money. For every online sale there are three entities benefiting from this additional sale amount.

#1 – Selling Platforms. Transaction fee, or a % of the total sale going to the online platform. Be it Etsy, Amazon, Ebay or others. The higher the final cost for the sale, the more the selling platform makes.

#2 – Payment Processors. Payment processing fee, or a % of the total payment processed for the transaction. Again, the higher the final cost for the sale, the more the payment processor makes.

#3 – Sales Tax States – Most state sales tax rates are only applied to the purchase price, not the shipping. But when shipping is rolled into the purchase price, then the entire amount is taxable. More money for the state.

True, for Susie’s purchase, a % fee on the extra $.40 is a pittance. But charging the fees on that additional amount over millions of transactions or hundreds of millions of $$… well you do the math.

Author: Jef Spencer, Owner/Craftsman of Refined Pallet. Shops on Etsy, Amazon and Ebay.